How AI Stock Selection Works: A Technical Deep Dive into Machine Learning Portfolios

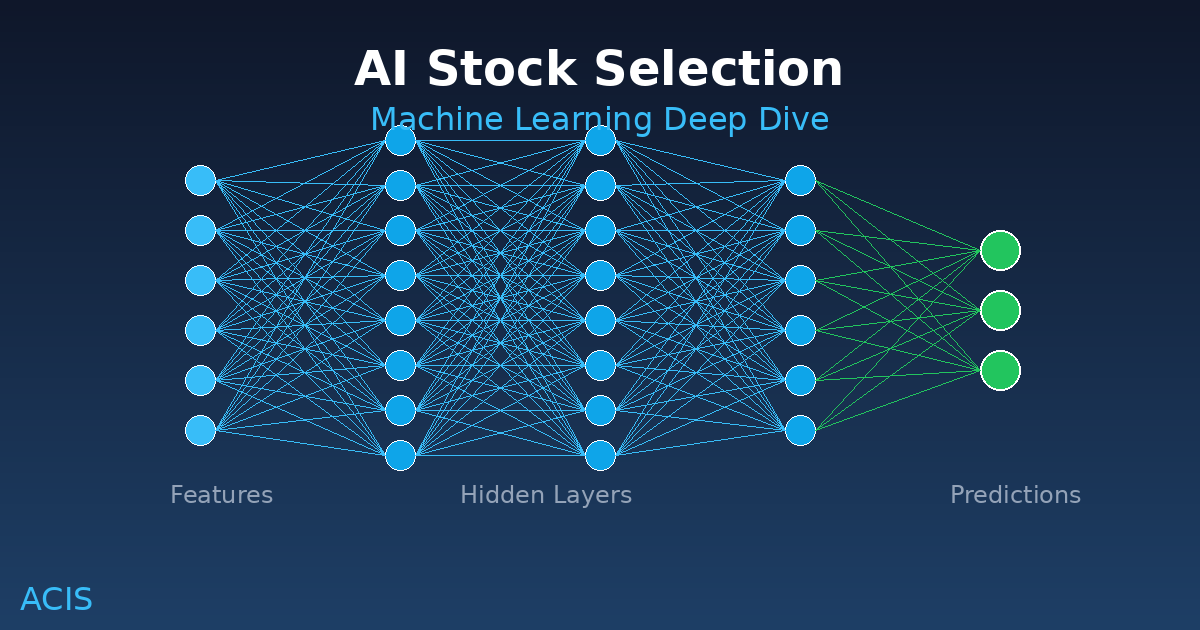

Explore the machine learning technology behind AI-powered stock selection. Learn how LightGBM, feature engineering, and reinforcement learning create institutional-grade portfolios.

Introduction: The Science of AI Investing

Artificial intelligence has transformed industries from healthcare to transportation. Now it's revolutionizing how we invest. But what exactly happens when an AI selects stocks? This technical deep dive explains the machine learning pipeline behind modern AI-powered portfolio management.

The Machine Learning Pipeline

Step 1: Data Collection

AI stock selection begins with massive datasets. A typical ML investing platform ingests:

- Price data: 10+ years of daily OHLCV (Open, High, Low, Close, Volume)

- Fundamental data: P/E ratios, earnings, revenue, debt levels, dividend yields

- Technical indicators: Moving averages, RSI, MACD, Bollinger Bands

- Alternative data: Sentiment scores, insider trading, institutional holdings

For a universe of 3,000+ stocks, this represents millions of data points updated daily.

Step 2: Feature Engineering

Raw data isn't directly useful for machine learning. Feature engineering transforms it into predictive signals:

Momentum Features:

- 1-month, 3-month, 6-month, 12-month returns

- Relative strength vs. sector and market

- Price distance from 52-week high/low

Fundamental Features:

- P/E ratio relative to sector median

- Earnings growth acceleration

- Return on equity trends

- Debt-to-equity changes

Technical Features:

- RSI (Relative Strength Index) levels

- MACD crossover signals

- Volume trends and anomalies

- Volatility measures (historical and implied)

Quality Features:

- Earnings consistency

- Revenue predictability

- Balance sheet strength scores

A production system might use 50+ engineered features per stock.

Step 3: Model Training

The most common algorithm for tabular financial data is LightGBM (Light Gradient Boosting Machine). Here's why:

Why LightGBM for Stock Selection:

- Handles missing data naturally (common in financial datasets)

- Fast training on large datasets

- Resistant to overfitting with proper regularization

- Captures non-linear relationships

- Provides feature importance rankings

Training Process:

- Split historical data into training and validation sets

- Train model to predict future returns (or return rankings)

- Validate on out-of-sample data to prevent overfitting

- Retrain daily/weekly to adapt to market regime changes

Avoiding Common Pitfalls:

- Look-ahead bias: Never use future data in training

- Survivorship bias: Include delisted stocks in historical data

- Overfitting: Use cross-validation and regularization

- Regime changes: Retrain regularly, don't rely on decade-old patterns

Step 4: Strategy-Specific Models

One-size-fits-all doesn't work in investing. Sophisticated platforms train separate models for each strategy:

| Strategy | Target Variable | Key Features Weighted |

|---|---|---|

| Value | Undervaluation score | P/E, P/B, EV/EBITDA |

| Growth | Future earnings growth | Revenue growth, EPS acceleration |

| Dividend | Yield sustainability | Dividend history, payout ratio |

| Momentum | Short-term returns | Price momentum, relative strength |

Each model learns what "good" looks like for its specific strategy.

Step 5: Position Sizing with Reinforcement Learning

Stock selection is only half the puzzle. How much to allocate to each stock matters enormously.

Reinforcement Learning (RL) optimizes position sizes by:

- Simulating thousands of portfolio scenarios

- Learning which allocations maximize risk-adjusted returns

- Adapting to correlation structures between positions

- Respecting constraints (max position size, sector limits)

Popular RL Algorithms:

- PPO (Proximal Policy Optimization): Stable, sample-efficient

- SAC (Soft Actor-Critic): Good for continuous action spaces

- A2C (Advantage Actor-Critic): Fast training

The RL agent learns to balance:

- Expected returns from ML predictions

- Portfolio diversification

- Transaction costs

- Risk constraints

The Prediction Pipeline

Here's what happens when the AI makes daily predictions:

```

- [Market Close] → New price and fundamental data arrives

- [Feature Update] → Calculate 50+ features for 3,000+ stocks

- [ML Prediction] → Each strategy model scores all stocks

- [Ranking] → Convert scores to rankings within universe

- [RL Optimization] → Determine optimal position sizes

- [Constraint Check] → Apply risk limits and sector caps

- [Trade Generation] → Output buy/sell recommendations

```

Validation: How Do We Know It Works?

Backtesting is necessary but not sufficient. Robust validation includes:

Walk-Forward Analysis:

- Train on 2015-2020, test on 2021

- Train on 2015-2021, test on 2022

- Train on 2015-2022, test on 2023

- Check consistency across all periods

Key Metrics:

- Information Coefficient (IC): Correlation between predictions and actual returns

- Hit Rate: Percentage of correct directional predictions

- Long-Short Spread: Return difference between top and bottom quintiles

- Sharpe Ratio: Risk-adjusted returns

Reality Checks:

- Does it work after transaction costs?

- Does it work across different market regimes (bull, bear, sideways)?

- Is performance concentrated in a few lucky picks or distributed?

Why ML Beats Traditional Analysis

| Traditional Analysis | ML Analysis |

|---|---|

| Analyzes 10-50 stocks deeply | Analyzes 3,000+ stocks consistently |

| Subjective factor weighting | Objective, data-driven weights |

| Slow to adapt to new data | Updates daily |

| Prone to cognitive biases | Systematic, emotion-free |

| Limited pattern recognition | Finds complex, non-obvious patterns |

The Future: What's Next for AI Investing

Emerging techniques pushing the frontier:

- Transformer models (like GPT) for sequence prediction

- Graph neural networks for modeling stock relationships

- Multi-task learning for related prediction objectives

- Alternative data integration (satellite imagery, web scraping)

- Explainable AI for understanding why models make decisions

Conclusion

AI stock selection isn't magic—it's rigorous engineering applied to financial data. The combination of:

- Comprehensive data collection

- Thoughtful feature engineering

- Strategy-specific ML models

- RL-optimized position sizing

- Robust validation frameworks

...creates a systematic approach that can compete with institutional investors at a fraction of the cost.

Experience AI-powered investing firsthand. Start your free trial today.

Tags

Ready to invest with AI?

Get institutional-grade stock picks for just $19/month.

Start 15-Day Free Trial